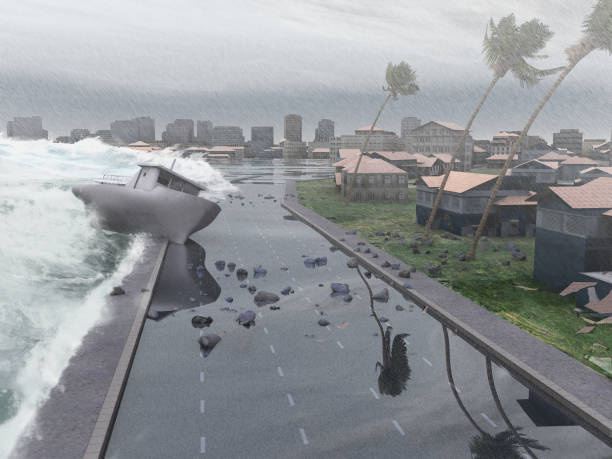

Wind & Hail Insurance Coverage

Content

Our experienced brokers can help you with any paperwork and to manage your coverage. Call us when you have any questions about this valuable coverage. Helpful life insurance agents, who can help you in servicing your policy, are just a telephone call away. Many or all the products featured listed under are from our companions who compensate us. This could affect which merchandise we write about and where and how the product seems on a web page. This could affect which merchandise we evaluate and write about , nevertheless it by no means impacts our recommendations or advice, that are grounded in thousands of hours of analysis.

Natural causes generate approximately 44% of all power outages. The top causes measured by the average number of affected utility customers embrace earthquakes, hurricanes, ice, and tropical storms. The variety of power outages is increasing primarily as a outcome of aging power grid facilities and the elevated frequency of extreme weather events. In essence, as a home owner, you must often examine your roof, siding, gutters, and water run-off and drainage systems to ensure every thing is in good shape.

Making Ready Before A Twister, Hurricane Or Wind Occasion

This reporting of estimated insured storm losses is a service supplied by the Insurance Commissioner to the insuring public and information media. If a person presents himself as a public adjuster, ask for his licensing data. A public adjuster is an expert claims handler who is licensed and controlled by the state. The public adjuster is employed by the policy holder to help with the claims course of. After you’ve documented the damage, make the repairs needed to forestall further harm. DO NOT make any everlasting repairs before the insurance company is in a position to examine the harm and your insurance coverage carrier approves the repairs.

Fraudulent individuals usually take benefit of the chaos following a catastrophe. Check with the state Department of Consumer Protectionto ensure contractors are correctly licensed and/or registered and get references before hiring a contractor to make repairs. Always insist on a written estimate earlier than repairs start and don't sign any contracts before the adjuster has examined the damage.

Business Insurance Quote

It offers coverage for the perils of wind and hail in the coastal space of the state designated by the Legislature as "Beach." The territory is defined by state regulation. It’s not unusual that certain states have insurance legal guidelines that mandate either the kinds of coverage or insurance minimums that should be included for a specific class of insurance. Based on the coverages you purchase, hurricane insurance coverage can cover your own home for damages from heavy rains, wind, flooding, storm surges, tornados, and presumably even different weather-related perils. If you personal property positioned close to a large physique of water, you want to consider purchasing flood insurance by way of the National Flood Insurance Program. Immediately after a hail storm, call Ask An Adjuster Claims Adjusting to schedule a FREE inspection of your property to report any damage.

Is Critical Storm Damage Assistance Coming for Otsego County from NY State? - CNY News

Is Critical Storm Damage Assistance Coming for Otsego County from NY State?.

Posted: Thu, 02 Sep 2021 07:00:00 GMT [source]

For instance, if your personal home is insured for $500,000 and you've got a 5% hurricane deductible, you'd be responsible for covering the primary $25,000 price of harm. This means it is sensible to have a plan to cover your share within the aftermath of a disaster. A poorly maintained roof can unleash a flood of rainwater into your home that will not be coated.

EAGLE stands for Ending Arguments Gently, Legally and Economically. If you’re stuck in the home for days, preserve meals and water until you will get out and replenish your provides. And remember to discover out if there is a boil order in your area. No matter how a lot you put together for a hurricane, there shall be damage. Sparks from an open flame could ignite a fire or trigger a gas-related explosion in a broken constructing. Anything that may be picked up by the wind and subsequently blown in opposition to your home should be secured forward of time.

Your householders coverage doesn't cover earth movement, which incorporates landslides, mudflows, and erosion. You can usually add earthquake coverage for an extra premium. However, earthquake insurance coverage does not cowl a loss caused by landslides or erosion. Specialty protection for landslides may be obtainable; contact your insurance coverage agent. If a tree falls in your car, the injury could also be covered if you have comprehensive auto insurance coverage, which covers bodily injury aside from collision. Generally, a owners coverage only covers wind or hail damage to small watercraft and their trailers and accessories if the injury occurs whereas they are stored in a fully enclosed building. You could purchase a watercraft policy to cover physical injury to the craft.

You usually have little time to prepare and discover shelter from these pellets of frozen rain. If you've liability-only automobile insurance, you’re not covered for hail injury. You’ll want comprehensive protection if you'd like your insurance to assist pay on your automobile to be repaired after a hail storm.

Is wind driven rain damage covered by insurance?

Before you call your insurance company, you should call a roofer who will not only assess the roof damages, but can directly deal with insurance companies as well.

Follow the following tips to be sure you've adequate hurricane protection on your house. Do not pay a contractor the complete amount up entrance or sign over your insurance settlement payment. A contractor ought to anticipate to be paid a proportion when the contract is signed and the remainder when the work is accomplished. Once you've all this info, call your insurer’s claims heart to get a visit scheduled with certainly one of their claim adjusters to approve the dollar amount you’re requesting. In this video sequence, we’ve simplified complicated insurance coverage terms you’ll probably come across when shopping for protection.

However, you shouldn't get rid of any items that you simply believe may be a complete loss until the corporate consultant has examined them. For example, standard homeowners policies do not cover flood harm. This information accommodates extra information relating to damage as a end result of floods.

Worters, with the Insurance Information Institute, says the method is not sophisticated, but a pure catastrophe requires extra persistence. And there could be good purpose for not adding this to your coverage. A water pipe on the second flooring burst inflicting a flood of water throughout my home. Paul A. Eisenstein is an NBC News contributor who covers the auto trade. There are also plenty of scam artists, the NICB notes, who make a residing out of buying flooded autos at discount costs. The cars are cleaned up, then taken out of state where the VIN is switched and the automotive is retitled with no indication it has been damaged.

Did you know that flood insurance does not cover wind damage, and that wind and hail insurance does not cover... https://t.co/PpaukWwUur

— dee tru (@truinsurancesvc) August 17, 2017

Once they are on the bottom, they may or might not pay for the particles removal. You should contact your agent or firm relating to particles elimination coverage. Your insurance coverage accommodates limits on how much you probably can acquire for repairing and changing damaged or destroyed property. It is essential to get a basic understanding of what these limits are earlier than hiring or agreeing to pay any professional in connection with your loss and insurance declare. Disputes between property homeowners and insurance coverage adjusters over the amount and cost of necessary repairs are quite common. Consumer advocates suggest that a property owner get at least two estimates from licensed native restore professionals and examine them with the insurance coverage company’s provide. It is finest to succeed in an agreement on the value of your loss with your insurance company earlier than starting repairs.

With just some clicks you presumably can access the GEICO Insurance Agency companion your boat insurance coverage is with to search out your policy service options and contact info. We looked at customer experience, coverage, discounts and extra to determine the best residence insurance coverage corporations. The following 19 coastal states and Washington, D.C., permit insurers to cost special deductibles for hurricane injury, based on the Insurance Information Institute.

The season for hail, floods, tornadoes and wind that can damage your home is almost here, and even arrived early for some of you. It’s not a bad idea to schedule a home insurance checkup with your agent: https://t.co/yrJgx9tcX9 pic.twitter.com/o9vRUzMfhV

— Shelter Insurance (@Shelter_Ins) Get More Information March 11, 2020

It’s protected from damage caused by windstorms, explosions, lightning, and fires. She received a payout of $2,500 to remove the tree and to repair the roof and fence. According to the National Flood Insurance Program , floods cause billions of dollars in property injury in the us yearly. If you live in a high-risk area, your home has a 26% chance of being damaged by flooding through the course of your 30-year mortgage, in comparison with a 10% chance of being damaged by home hearth. Being that NC is situated on the Atlantic coast insurance companies have put some fantastic print in your insurance policies that may trigger you to not have protection for a serious wind event.

Your policy may also include protection for smoke injury, harm attributable to falling objects, or severe winds. Your complete automobile insurance policy may also cowl a rental automobile whereas your automobile is being repaired. If the storm has additionally broken your own home, you will want to verify your owners insurance coverage policy to see what forms of storm damage are covered. Typically wind or tornadoes, wildfire, ice storms, fallen bushes and lightning strikes have a certain level of protection as part of a standard coverage. Make positive you perceive the types of storms that are coated by your particular coverage before a disaster quite than after. There are additional coverages you could want to think about to provide yourself a broader range of protection. Things like matching siding protection, roof replacement cost protection and sump pump overflow coverage are necessary coverages to add to raised protect yourself from storm injury.

Can an insurance company make you replace your roof?

Although windstorm insurance can be expensive, it's still significantly cheaper than paying to repair storm damages yourself. For instance, if your home insurance policy's wind coverage limit was $100,000 and a hurricane caused $300,000 worth of damage, you would have to pay the remaining $200,000 out of pocket.

You may have a robust emotional connection to your car, but if it has been in a flood, it may be too costly to repair. That's as a end result of “when water enters your engine’s air consumption, it could result in all kinds of problems,” says John Ibbotson, chief mechanic for Consumer Reports. This is devastating to householders, significantly to snowbirds in Florida who're away part of the year or owners away from their property on vacation or for business. It is an enormous deal and will prove to be very expensive.Policyholders ought to be up in arms on this issue and get in touch with their native legislative workplace and their Office of Insurance Regulation. You should pay attention to something called a Black Water Loss.The handling of this type of loss is completely totally different and requires particular care and treatment. A black water loss results from sewage or different chemical toxins in the water being released in your home or business. Simply drying out this kind of moisture is not going to rid your property of those points.

How hurricane season can impact your home & auto insurance, according to an expert - Fox Business

How hurricane season can impact your home & auto insurance, according to an expert.

Posted: Tue, 14 Sep 2021 15:54:02 GMT [source]

Homeowners insurance typically doesn't cowl injury attributable to flooding. If your sump pump system ever fails or the facility goes out, water overflow might occur. Having this protection gives you that extra layer of protection.

What does a wind only policy cover?

Flood insurance covers losses directly caused by flooding. Property outside of an insured building. For example, landscaping, wells, septic systems, decks and patios, fences, seawalls, hot tubs, and swimming pools. Financial losses caused by business interruption.

Purchasing extra insurance to complement general insurance coverage policy is sometimes essential for high-risk areas. An anti-concurrent causation clause is a house owner coverage that covers wind and hail injury is and exclusion if, on the identical time, a flood happens. When you borrowed money to purchase your home, your mortgage company grew to become invested in it. If you don’t use insurance cash to make repairs, the property is value less, so the mortgage firm wants to ensure the insurance coverage cash is used to protect its funding.

You should contact your agent and review your policy and any applicable endorsements for specific coverage. If a tree or tree limbs land on the garden and don't harm a construction, the insurance coverage company is often not required to pay to have them removed, reduce up, or hauled off. Your insurance coverage firm can not make a check for a claim payable only to the mortgage firm. If they do, you must refuse to accept it and demand the verify be reissued to you and your mortgage firm. Usually, if the damage is more than $10,000, the mortgage company have to be named on the verify.

Insured Damage From Germany’s Deadly July Floods Estimated at €7B ($8.2B) - Insurance Journal

Insured Damage From Germany’s Deadly July Floods Estimated at €7B ($8.2B).

Posted: Fri, 27 Aug 2021 07:00:00 GMT [source]

However, you have to read your contract, as a end result of there are some circumstances during which if you're in default, the insurance coverage proceeds may be applied to what you owe, but they must ask your permission. Nowadays, insurance coverage firm letters and checks are seldom sent from the same central processing center, making it difficult for the examine to accompany a letter of explanation.

2021 most expensive catastrophe year yet for German insurers, says GDV - Reinsurance News

2021 most expensive catastrophe year yet for German insurers, says GDV.

Posted: Fri, 03 Sep 2021 07:00:00 GMT [source]

Find out what protection is out there, and should you anticipate needing greater than your present policy provides, call your insurance coverage agent and make the mandatory changes. Insurance doesn't cover gradual harm, so leaving issues like leaking water until later may cost you a lot of money.

Your address on the time of the disaster and the handle where you are now staying. Despite the policyholders argument that flood within the coverage was ambiguous, the courtroom dominated that while the word was undefined, the definition from another Arkansas case might be used. However, you must first document the harm as best you possibly can by taking detailed pictures. Gather some other evidence as well, like newspaper articles detailing the storm or photos from neighbors. Screen for heightened risk individual and entities globally to help uncover hidden dangers in enterprise relationships and human networks. Call the CSI, or your insurer, to verify whether an adjuster is licensed. Insurance company adjusters don't work on fee, nor do they in any other case benefit by paying you less for a loss.

- If injuries occurred within the accident, generally the private harm lawyer will deal with the negotiation of the entire loss vehicle.

- Flood coverage is underwritten by the federal authorities through the National Flood Insurance Program, although the personal insurers could promote and handle this type of insurance.

- If you might have the automobile repaired you could possibly purchase the protection.

- Your windstorm deductible, or the amount you’ll pay out of pocket when filing a claim, is on a percentage-based system and relies on how much coverage you determined to purchase .

- If you bought a home or property within the wind pool a quantity of years ago, it was fairly widespread to have the separate Wind & Hail coverage.

- If you have accomplished major renovations or repairs, make an inventory of that, too, and upload all the documentation to the cloud so you probably can entry it remotely, Moss says.

- Your insurance providers will assist determine responsibility and tips on how to pay for repairs.

Note that if the storm affected widespread areas, customer support could presumably be delayed. Upload your present policy data and get quotes from 40+ companies. Get quotes in 30-seconds from 100+ firms, and save a mean of $800 or extra per yr. Discover coverage that’s broader than rivals, valuable reductions up to 30% off and perks like shrinking deductibles that reward no claims. GEICO has no management over the privateness practices of the companies talked about above and assumes no duty in connection together with your use of their web site. Any info that you just present directly to them is topic to the privacy coverage posted on their web site. It only takes a couple of minutes for hail to trigger plenty of damage to your vehicle.